As set out in Chapter 1 and summarised in Figure 1.5, the calculations underlying a business case can be seen as consisting of four components or modules:

-

a revenue module

-

a co-benefits module

-

a cost module

-

an adding up and risk module.

The discussion below provides examples of the revenue and co-benefits modules.

8.7.1 The revenue module of the business case calculations

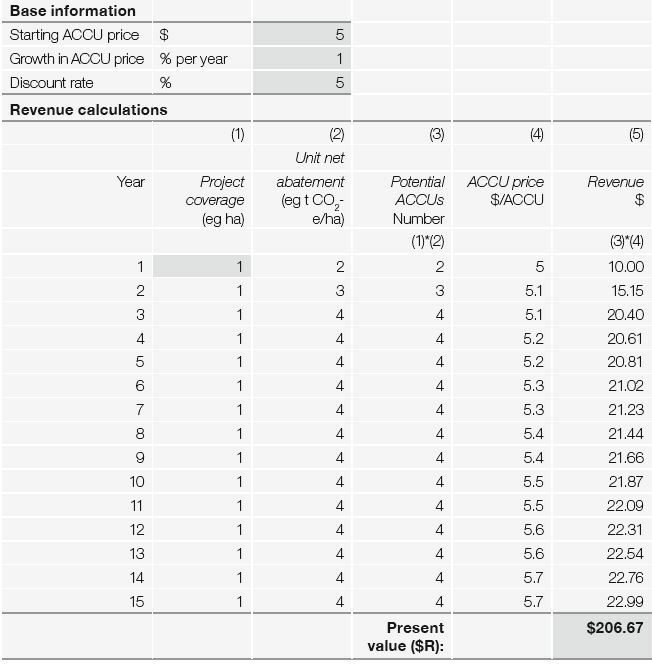

Figure 8.5 illustrates one way of constructing the revenue module for a carbon farming project (using an extract from a spreadsheet template). However, note the following:

-

The values shown in this extract are purely illustrative.

-

While the extract presents benefits over 15 years, that period is illustrative only and can be increased or reduced as appropriate to the particular project.

The spreadsheet extract shows how basic information—in particular, the ACCU price and its assumed growth over time, along with the discount rate—can be used to estimate revenue in each year.

Different assumptions about the ACCU price and its growth can be tested in a spreadsheet (particularly when combined with the other modules, as discussed further below). In the example shown, the starting ACCU price is A$5 and grows at 1% a year. The discount rate is 5%.

In this extract:

-

annual revenues are all expressed in real terms (that is, the effect of inflation has been removed from the analysis)

-

results are expressed in units per hectare.

Unit (that is, per hectare) net abatement for each year is specified. This could correspond, for example, to annual sequestration from a revegetation project or a soil carbon project. Unit net abatement could be constant over time, decreasing, or following some other pattern relevant to the particular project. In this example, it starts at 2 tonnes, increases to 4 tonnes and then remains constant.

Note that net abatement will not necessarily commence in Year 1. Potential ACCUs are derived as the product of the project coverage (ha) and unit net abatement (t CO2-e/ha). When multiplied by the assumed ACCU price, this gives a revenue in each year. Revenues from all years are added together (using the discount rate) to convert total revenue to a present value. In this example, the present value is A$206.67.

Figure 8.5: Establishing the revenue module: spreadsheet extract |

|

|

Data source: CIE

8.7.2 The co-benefits module of the business case calculations

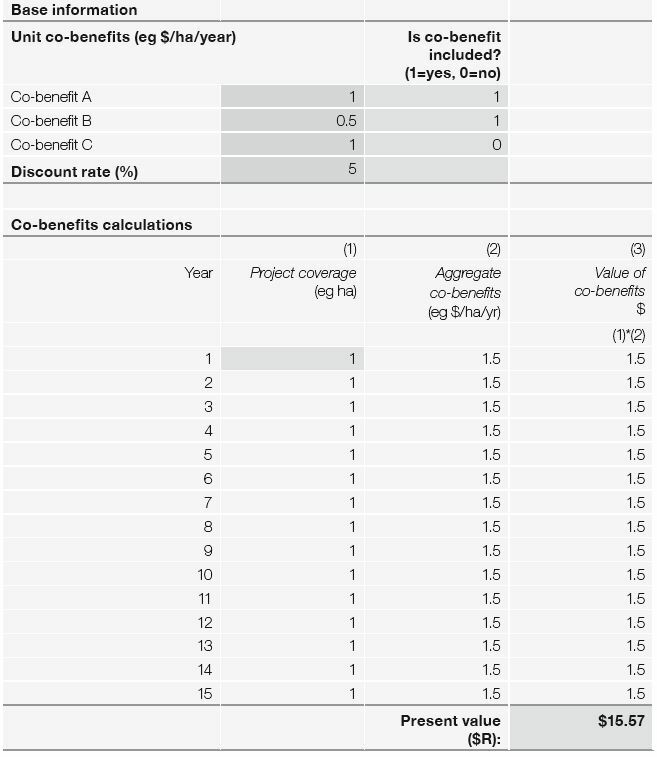

Figure 8.6 shows a spreadsheet extract for a template that estimates the value of cobenefits. The basic structure is very similar to the revenue module template. In this case, however, the extract has a facility for different types of co-benefits (A, B or C), as well as a facility to switch them on or off. In the example, co-benefit C is switched off.

Figure 8.6: Establishing the co-benefits module: spreadsheet extract |

|

|

Data source: CIE.

As for the revenue module, the base unit for project coverage is hectares and the

aggregate co-benefits are applied to an area in order to generate a value of co-benefits, and then to generate a present value.

While in this example co-benefits are uniform in each year, that is not necessarily the case. In addition, co-benefits will not necessarily commence in Year 1.

Explore the full Workshop Manual: The business case for carbon farming: improving your farm’s sustainability (January 2021)

Read the report

RESEARCH REPORTS

1. Introduction: background to the business case

This chapter lays out the basic background and groundwork of the manual

RESEARCH REPORTS

1.2 Being clear about the reasons for participating

Introduction: background to the business case

RESEARCH REPORTS

1.4 Working through the business case for carbon farming

Introduction: background to the business case

RESEARCH REPORTS

1.5 Factors determining project economics

Introduction: background to the business case

RESEARCH REPORTS

1.8 Important features of the business case

Introduction: background to the business case

RESEARCH REPORTS

2. How carbon is farmed under the ERF

This chapter considers in detail the activities that constitute carbon farming

RESEARCH REPORTS

2.5 Carbon farming under the Emissions Reduction Fund

How carbon is farmed under the ERF

RESEARCH REPORTS

3. The policy context and the price of ACCUs

This chapter takes a broad look at the policy context for carbon farming