This section provides historic information on how the CFI worked. Projects registered under the CFI transitioned to the ERF in December 2014.

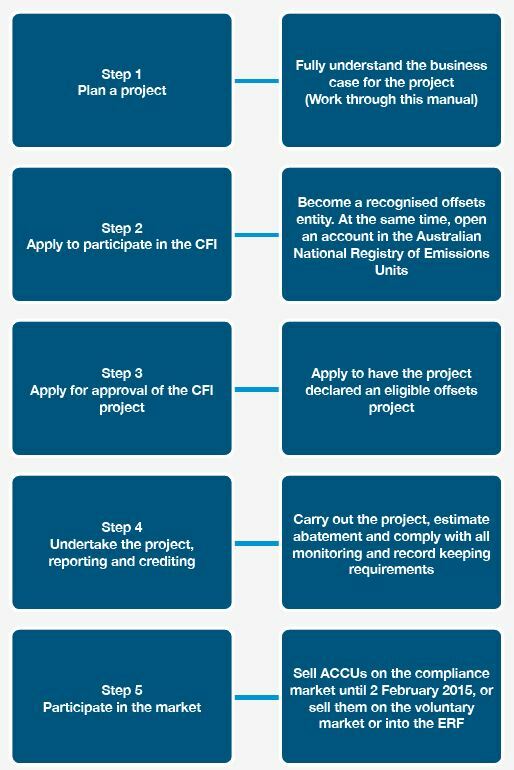

Figure 6.1 summarises the key steps that interested parties took in relation to a CFI project

Figure 6.1: Steps for participating in the CFI |

|

|

Source: Clean Energy Regulator

6.2.1 Step 1: Plan a project

This step involves the basic business case assessment as outlined in this manual.

Keep in mind that all projects must use an approved methodology (also called a ‘methodology determination'). The methodologies set out the rules for implementing your project.

At the planning stage, it is important to be aware that an ACCU is a ‘financial product' under the Corporations Act 2001 and the Australian Securities and Investments Commission Act 2001. Therefore, if an individual or company carries out certain types of activities, known as ‘financial services', in relation to ACCUs they are required to obtain an Australian financial services licence, unless an exemption applies (see Appendix C for further information). If you simply carry out a project and sell your ACCUs on your own behalf, you will not normally need to hold an Australian financial services licence because you are likely to be covered by an exemption. However, the need for a licence can sometimes be a ‘grey' area. If you are uncertain about the requirement to hold a licence, you should seek legal advice.

A condition of registration for carbon sequestration projects is that all parties with an eligible interest in the land agree in writing to allow the project to go ahead. Eligible interest holders may include financial institutions and Registered Native Title Bodies Corporate. In Western Australia, projects on Crown Land require the Minister for Lands to provide the State's eligible interest holder (EIH) consent. For more details on State EIH, refer to the DPIRD webpage or contact Department of Planning, Lands and Heritage (DPLH) directly.

6.2.2 Step 2: Apply to participate in the Carbon Farming Initiative

Before a CFI project can be undertaken, the business entity needs to become a recognised offsets entity. A person who is granted recognition as an offsets entity has been assessed as a fit and proper person. This assessment is a requirement of the Carbon Credits (Carbon Farming Initiative) Act 2011 and is designed to prevent noncompliance, deceptive or unfair conduct, and fraud.

Participation is open to individuals, sole traders, businesses, local, state and territory government bodies, and trusts.

When an entity applies to become a recognised offsets entity, the regulator recommends that the project nominate to open an account with the Australian National Registry of Emissions Units. The registry is a secure electronic system designed to accurately track the location and ownership of ACCUs issued in Australia. Any credits earned under the CFI will be issued into the registry account.

6.2.3 Step 3: Apply for approval of the CFI project

The project will need to be declared an eligible offsets project. When applying for a project to be declared, you must demonstrate that it meets all of the eligibility criteria set out in the relevant methodology determination, as well as the Carbon Credits (Carbon Farming Initiative) Act.

The key steps to ensure that a project is eligible are set out in Figure 6.2. They include ensuring that the proponent has the right to undertake the project and that there is an appropriate methodology.

6.2.4 Step 4: Undertake the project—including reporting and crediting

Once the project is declared an eligible offsets project, it can begin. It must comply with regulatory requirements for estimating abatement and with the monitoring, record-keeping and reporting requirements according to the rules and instructions set out in the methodology determination for the project. The project must also comply with the general reporting and notification requirements in the Carbon Credits (Carbon Farming Initiative) Act.

Those obligations include collecting, maintaining and retaining accurate and complete records, undertaking quality assurance measures, providing specific information in an offsets report for the project, and submitting the offsets report to the regulator.

Applying for ACCUs under the CFI involves submitting an application for a certificate of entitlement, along with a project offsets report and an audit report that must be completed by a registered national greenhouse and energy auditor. The regulator will assess applications for a certificate of entitlement to ensure that the abatement can be verified and that the unit entitlement figure is correct. Successful applicants will be issued with a certificate of entitlement that advises of the number and type of ACCUs that the offsets project is entitled to receive for the reporting period.

6.2.5 Step 5: Participate in the market

The compliance market was underpinned by the requirement in the Clean Energy Act 2011 for certain entities, known as ‘liable entities', to surrender one eligible carbon unit for each tonne of CO2-e emissions they have produced in a year.

The repeal of the Clean Energy Act and the termination of the carbon pricing mechanism established by that Act saw the compliance market for ACCUs under the carbon pricing mechanism end on 1 July 2014.

All liable entities had to report a final emissions number for 2013-14 by 31 October 2014. Final liability was determined by the final emissions number minus provisional liability (if any). Liable entities were required to surrender sufficient emissions units to meet their final liability by 2 February 2015.

After 2 February 2015, the voluntary carbon market became the main option for selling ACCUs. In Australia, the voluntary carbon market is made up of individuals and organisations making voluntary commitments to offset carbon emissions or producing carbon-neutral goods and services under the Climate Active Carbon Neutral Standard (previously known as the National Carbon Offset Standard), as part of Climate Active. Climate Active is a partnership between the Australian Government and Australian businesses to encourage voluntary climate action.

To access the voluntary carbon market, project proponents and willing buyers of ACCUs may establish a commercial relationship and deal directly with each other or use a financial services provider.

Services providers include brokers who arrange the sale of ACCUs, banks and other traders who can buy ACCUs, and organisers of collective pools of ACCUs to access wholesale market prices. When dealing with any of these service providers, you should make sure that your contact has an Australian financial services licence.

Figure 6.2: Steps to ensure that a project is eligible under the CFI |

|

|

Explore the full Workshop Manual: The business case for carbon farming: improving your farm’s sustainability (January 2021)

Read the report

RESEARCH REPORTS

1. Introduction: background to the business case

This chapter lays out the basic background and groundwork of the manual

RESEARCH REPORTS

1.2 Being clear about the reasons for participating

Introduction: background to the business case

RESEARCH REPORTS

1.4 Working through the business case for carbon farming

Introduction: background to the business case

RESEARCH REPORTS

1.5 Factors determining project economics

Introduction: background to the business case

RESEARCH REPORTS

1.8 Important features of the business case

Introduction: background to the business case

RESEARCH REPORTS

2. How carbon is farmed under the ERF

This chapter considers in detail the activities that constitute carbon farming

RESEARCH REPORTS

2.5 Carbon farming under the Emissions Reduction Fund

How carbon is farmed under the ERF

RESEARCH REPORTS

3. The policy context and the price of ACCUs

This chapter takes a broad look at the policy context for carbon farming