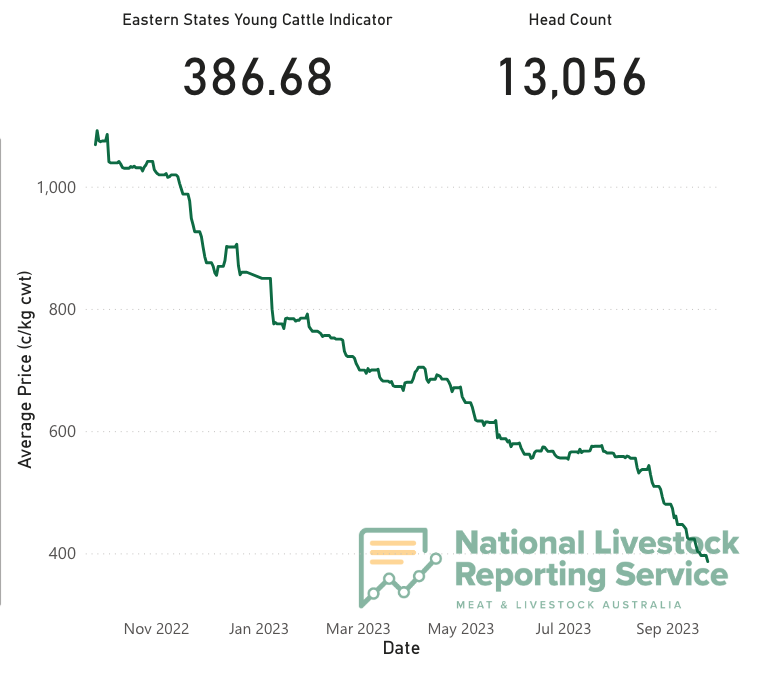

The Eastern Young Cattle Indicator (EYCI) finished last week at 397 cents per kilogram (c/kg) carcase weight (ct), down 6.4 per since the previous week and 679c down since the same time last year. As of today, the EYCI sits at 392.39c/kg cwt, which compared to a year ago is a decline of 676c/kg cwt, with the average price per head down from $1069 to $710.21.

The EYCI has plummeted over the last 12 months to 386.68. Chart courtesy of MLA.

Meat & Livestock Australia (MLA) global supply analyst, Tim Jackson, reported on Friday the restocker component of the indicator was weaker than the EYCI overall, 21c below the EYCI at 376c/kg cwt on Friday.

He said in general, restocker demand slipped, with the restocker yearling heifer indicator falling 21c over the week to 156c/kg live weight (lwt).

SLAUGHTER ON THE RISE

The previous week saw cattle slaughter rise by 963 to 126,585 head, hitting the second largest week for the year so far, with weekly slaughter numbers close to or even above levels seen in mid-2020, according to MLA. This upward trend has continued in line with rising cattle supplies.

Slaughter volumes are expected to continue at a high level following the Bureau of Meteorology's (BOM) declaration of El Niño and a position Indian Ocean Dipole last week.

Mercado analyst Ethan Woolley said on Friday cattle slaughter last week on the east coast was 44 per cent higher year on year and the same level of productivity would likely be required for the next month to move through the cattle that may head to market following BOM's announcement.

HEAVY STEER DISCOUNT TO YOUNG CATTLE FLIPPED

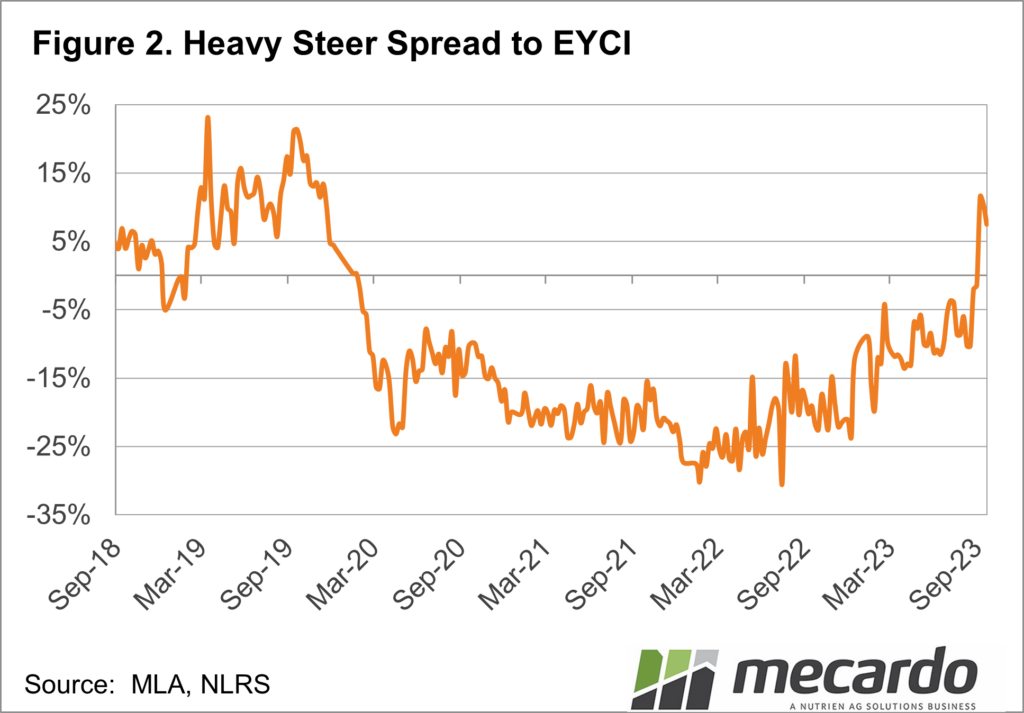

Woolley said the drop in the EYCI has flipped the heavy steer discount to young cattle, which has the potential to coax those confident in their feed base back into the young cattle market.

Heavy Steer Spread to EYCI. Chart Courtesy of Mecardo.

He said while the National heavy steer indicator dropped last week, losing 19c to finish the week at 233c/kg live weight, the young cattle price decline in the last few months has outpaced the finished cattle pricing.

"We are back to a position where young cattle are now at a discount to heavy steers at a national level, potentially presenting an opportunity for those that might have a feed platform heading into 2024," Woolley said.

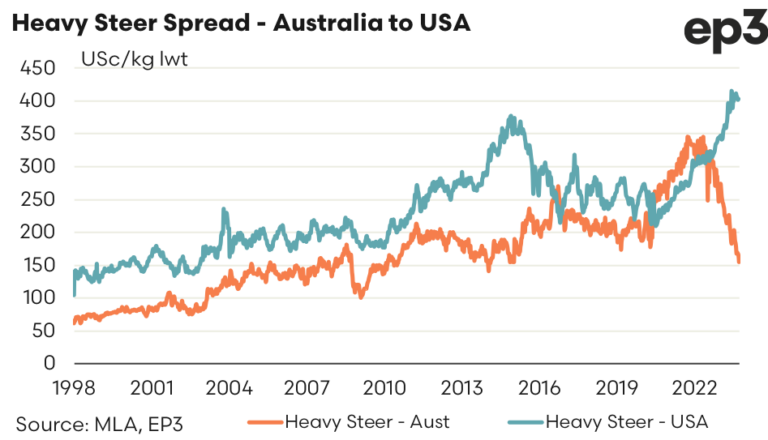

AUSTRALIA/USA HEAVY STEER PRICE GAP WIDENS

Meanwhile, episode3 market analyst Matt Dalgleish said on Friday the recent decline in Australian heavy steer pricing has widened the spread between Australian and United States (US) equivalent heavy steer prices to the highest level on record.

Heavy Steer Spread- Australia to USA. Chart Courtesy of episode3.

"Converting Australian Heavy Steer pricing to US cents per kilo shows the current domestic heavy steer price here is 249 cents below its US equivalent- in A$ terms that's a discount of around 390 cents,' Dalgleish said.

"Analysis of the percentage spread discount shows that the Australian Heavy Steer has moved to the widest discount on record at nearly 62 per cent this week, eclipsing the previous record of 59 per cent, which was set during the 2014 season - in the midst of the horrible 2013-15 drought.

"The long-term average percentage price spread between the Aussie and US heavy steer sits at a discount of 28 per cent, so the current level is nearing uncharacteristic extreme levels.

"These are levels normally seen when Australia goes through drought and cattle slaughter peaks above 9 million head per annum.

"Current slaughter volumes are only expected to reach around 7 million head in 2023, so the current pricing discounts are not representative of what is happening on the ground domestically."

According to Dalgleish the Australian herd rebuild appears to be coming to an end with much of the aggressive restocking buying seen in recent years moderated significantly as producers begin to prepare for a drier spell.

Comparatively, the US is into its fourth year of herd liquidation and historically towards the end of their liquidation cycle pricing often begins to peak as supply tightens, which he said has pushed US cattle prices to record levels during 2023.